The Banking, Financial Services, and Insurance (BFSI) sector has recently faced escalating cyber threats, exploiting vulnerabilities in file handling and data transfers.

BharatPay Data Breach

In 2022, BharatPay, a fintech company that provides various digital financial services to customers and merchants based in India, experienced a significant data breach where personal and transaction data of around 37,000 users were exposed online due to a security lapse in data handling practices.

LockBit Ransomware Attack

Similarly, in May 2023, a state-owned bank in Southeast Asia fell victim to the LockBit ransomware group, which gained access to the bank's network through compromised credentials, resulting in substantial data exfiltration.

Cosmos Bank Cyber Heist

Another recent example is the Cosmos Bank cyber heist, where hackers siphoned off $13.5 million in a coordinated attack across 28 countries, exposing the vulnerabilities in the banks file and data handling protocols.

These incidents underscore the critical importance of secure file management within the BFSI sector. Unverified uploads, insecure file exchanges, and reliance on removable media introduce substantial risk, making it easier for cyber threats to bypass traditional defenses. Financial institutions now require solutions that can detect and neutralize threats proactively while streamlining secure file handling to protect customer data and maintain trust.

This customer story examines how a leading Taiwanese bank addressed these challenges through OPSWAT’s MetaDefender Managed File Transfer (MFT) and MetaDefender Core. By integrating these advanced security solutions, the bank reinforced its defenses against file-based threats, safeguarding operations and sensitive client information.

Increasing Risks in File Management

Realizing that cyberthreats continue to evolve, the bank evaluated its current methods for handling file transfers and determined that it had several security gaps. In particular, the reliance on USB devices for internal file transfers exposed the bank to potential data leakage and malware risks. Without an effective means of tracking and verifying USB-based file transfers, the bank faced heightened risks of sensitive data exposure and external threats.

Our reliance on USB drives for internal transfers created significant vulnerabilities in our file handling processes. Without proper security checks, there was always the risk of malicious files entering our network or data leaking unintentionally.

IT Security Manager

Additionally, the bank encountered issues with unverified file uploads, especially during national relief initiatives that required clients to submit large volumes of documents. With no mechanism in place to validate these uploads, the bank’s systems were at risk of malware infections and unauthorized access. Handling these files safely became an urgent need, especially as the bank recognized the reputational and operational impact of a potential data breach.

Finally, frequent personnel transfers within the organization introduced additional data security challenges. Moving files between departments via manual methods was inefficient and posed compliance risks, as sensitive information could be exposed during the transfer. The bank required a solution to securely automate these file exchanges without disrupting day-to-day operations.

OPSWAT is Chosen to Secure File Management and Help Achieve Compliance

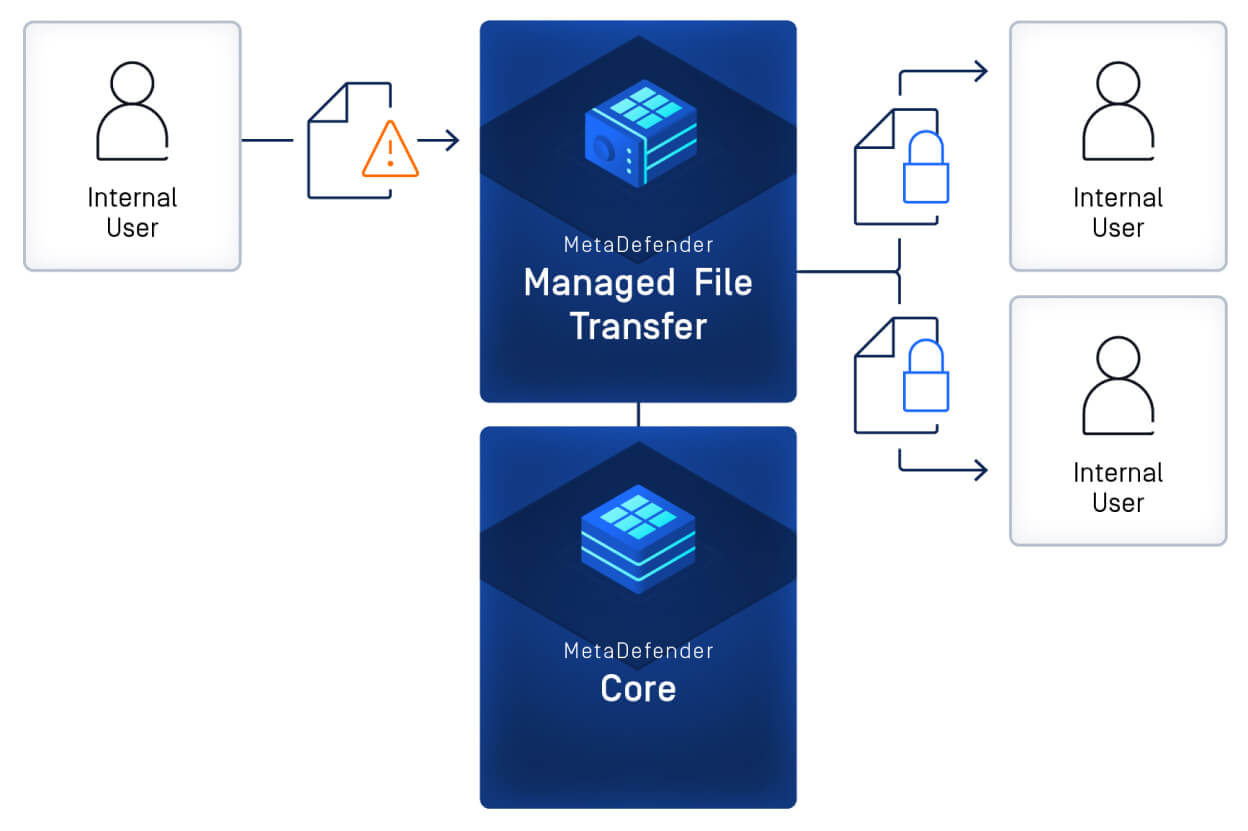

To address these critical challenges, the bank evaluated various cybersecurity solutions before selecting OPSWAT’s MetaDefender Managed File Transfer (MFT) and MetaDefender Core. OPSWAT’s solutions offered a unique combination of secure, automated file handling with advanced threat detection, enabling the bank to tackle both internal and external data risks. The native integration of MetaDefender Core and MetaDefender Managed File Transfer (MFT) provided a seamless way to scan files at every point of transfer, ensuring end-to-end security.

- Advanced Malware Scanning: MetaDefender Core utilizes Multiscanning with multiple antivirus engines and Deep CDR (Content Disarm and Reconstruction) to sanitize files, removing potentially harmful elements while preserving content.

- End-to-End Encryption: MetaDefender Managed File Transfer (MFT) encrypts data both in transit and at rest, ensuring that files remain secure throughout the transfer process.

- Automated Workflows: By automating file transfer processes, MetaDefender Managed File Transfer (MFT) eliminates manual handling errors and reduces the reliance on insecure USB devices.

- Compliance and Audit Trails: Both solutions support compliance with regulatory standards through detailed audit logs, role-based access control, and reporting features.

With OPSWAT’s solutions, we finally had a secure and reliable way to manage incoming files and internal transfers. MetaDefender Managed File Transfer (MFT) and MetaDefender Core together gave us the tools to proactively manage threats and reduce human intervention, making our processes both safer and more efficient.

IT Security Manager

Enhancing Security for Personnel Transfers

One of the immediate benefits of implementing MetaDefender Managed File Transfer (MFT) was the ability to securely manage file transfers during personnel shifts without using USB drives. Previously, when employees moved departments, they would rely on USB devices to transfer necessary files, which created opportunities for data leakage. Now, with MetaDefender Managed File Transfer (MFT)’s secure, automated platform, employees can upload and download files seamlessly between departments.

The centralized MFT platform eliminated the need for manual device handling and allowed the bank to maintain strict control over access. The solution’s role-based permissions ensured that only authorized personnel could access and transfer specific files, significantly reducing the risk of accidental or intentional data leaks. The secure transfer process not only improved efficiency but also enhanced the bank’s compliance with industry regulations by providing a transparent audit trail of all file movements.

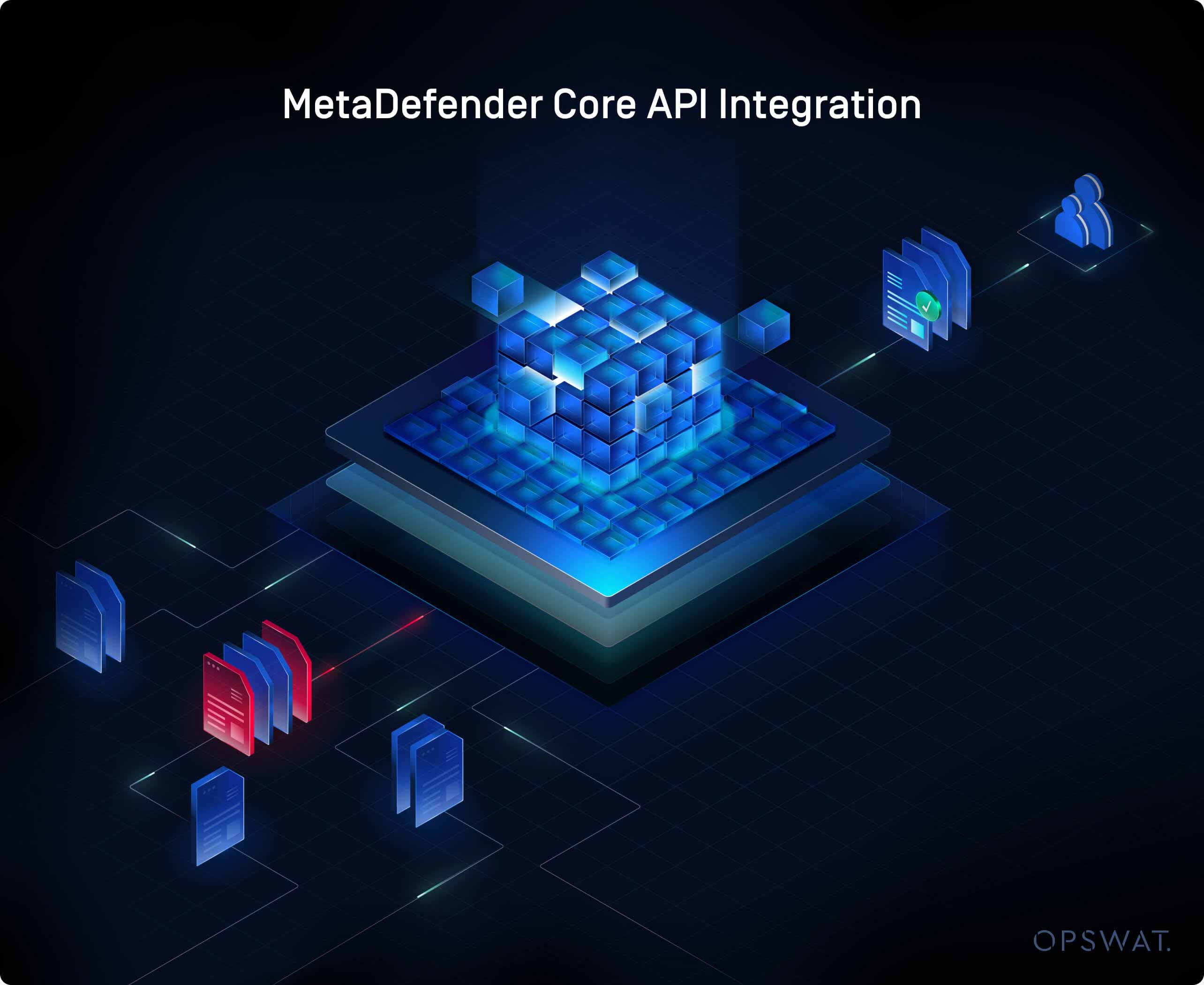

Securing Client File Uploads with MetaDefender Core API

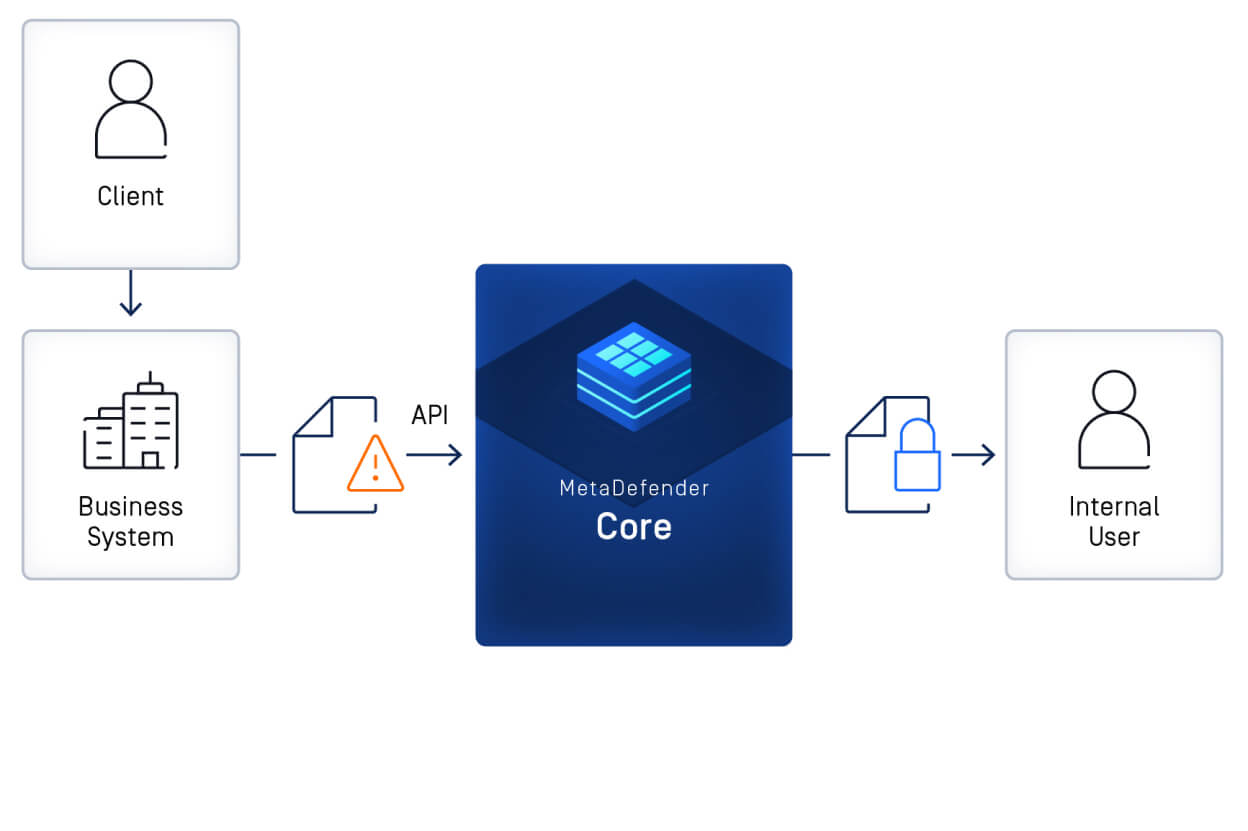

The MetaDefender Core application programming interface (API) became a cornerstone of the bank’s strategy for handling unverified client uploads. The bank integrated the API with its business systems to scan all incoming files, ensuring that each document passed through rigorous security checks before reaching internal systems. This solution was particularly valuable during large-scale file submissions for relief programs, where incoming files could otherwise introduce malware risks.

With Deep CDR technology, MetaDefender Core disarmed potentially harmful file content, stripping away embedded threats while preserving the original data. This proactive scanning approach allowed the bank to confidently manage high volumes of client uploads without sacrificing security. Multiscanning technology further enhanced detection accuracy by leveraging multiple antivirus engines, providing comprehensive protection against known and unknown threats.

The MetaDefender Core API integration allowed us to safely handle thousands of incoming files, knowing they were thoroughly scanned and sanitized. This integration helped us maintain operational integrity and protect our clients' sensitive data even during peak submission periods.

IT Security Manager

Transforming System Updates and Document Security

In addition to managing client uploads, OPSWAT’s solutions also streamlined the bank’s internal processes, including secure handling of system updates and sensitive document transfers. Files containing certificates, software updates, and other critical information were sanitized through the MetaDefender Core API integration, removing any potential threats before they entered the network. This scanning process ensured that even routine updates adhered to the bank’s stringent security standards, minimizing the risk of accidental malware infections.

With automated workflows, the bank no longer relied on manual interventions for handling sensitive files, resulting in faster, more efficient updates. The centralized control provided by MetaDefender Managed File Transfer (MFT)’s monitoring dashboard allowed the bank’s IT team to oversee all file movements in real-time, adding another layer of security to internal operations.

Meeting Compliance Standards with Audit and Control

Operating in a regulated financial industry, the bank had to ensure that its file management practices aligned with data protection and cybersecurity standards. MetaDefender Managed File Transfer (MFT)’s detailed audit logs and role-based access controls enabled the bank to meet these requirements easily. By generating reports and maintaining comprehensive records of all file transfer activities, the bank could demonstrate compliance during regulatory audits.

MetaDefender Managed File Transfer (MFT)’s flexible deployment options also supported the bank’s expansion across 297 branches, allowing it to implement consistent security policies across its entire network. This scalability ensured that each branch adhered to the same high standards of security, regardless of location. The bank’s leadership could now confidently manage data handling processes and respond promptly to any compliance inquiries, reinforcing the institution’s commitment to regulatory adherence.

A Secure and Efficient Transformation

Six months after implementing MetaDefender Managed File Transfer (MFT) and MetaDefender Core, the bank reported notable improvements in its cybersecurity and operational efficiency. Malware threats across the bank’s digital infrastructure decreased significantly, largely due to the proactive scanning and sanitization capabilities of MetaDefender solutions. By eliminating USB-based file transfers, the bank also significantly reduced the risk of data leakage and streamlined internal processes.

Reduction in Data Leakage

MetaDefender Managed File Transfer (MFT) replaced USB devices for personnel transfers, greatly reducing the risk of sensitive information being exposed. Role-based permissions provided further protection by ensuring only authorized users could access certain files.

Enhanced Operational Efficiency

MetaDefender Managed File Transfer (MFT)’s automated file handling workflows minimized the need for manual interventions, freeing up IT resources for other tasks. System updates and client file submissions were now processed securely and efficiently, with minimal human involvement.

Improved Compliance Readiness

With robust auditing and reporting tools, the bank could readily demonstrate compliance with industry standards. MetaDefender Managed File Transfer (MFT)’s detailed logging ensured transparency and accountability, enabling the bank to respond swiftly to audit requests and regulatory requirements.

Improved Threat Detection on Incoming Files

By integrating MetaDefender Core’s API into their business systems to scan all incoming files, the bank significantly increased its ability to detect and neutralize malware. This proactive approach reduced the risk of file-based threats entering the network, offering enhanced security for sensitive client data.

Streamlined Client File Handling

MetaDefender Core’s automated file scanning ensured that each uploaded document from clients was thoroughly inspected without manual intervention. This automated process allowed the bank to handle high volumes of client uploads quickly and securely, improving operational efficiency and reducing human error.

With MetaDefender Managed File Transfer (MFT) and MetaDefender Core, we’re not only more secure but also far more efficient in how we handle data. The solutions allowed us to move beyond reactive security and adopt a proactive, streamlined approach to cybersecurity.

IT Security Manager

Setting a New Standard in Secure File Management for Financial Institutions

The implementation of OPSWAT’s MetaDefender Managed File Transfer (MFT) and MetaDefender Core has redefined the bank’s approach to file management and security. By tackling specific challenges around unverified uploads, USB-based transfers, and internal file exchange, the bank has set a new benchmark for data security in the financial sector. OPSWAT’s solutions have empowered the bank to manage data securely, maintain compliance, and confidently face the evolving landscape of cyber threats.

For this Taiwanese bank, MetaDefender solutions were not merely tools but essential components of a resilient cybersecurity framework. This case highlights the transformative impact of a holistic, secure file management solution—giving financial institutions the peace of mind they need to focus on growth and innovation in an increasingly complex digital world.