Based on a report published by IBM, the global average cost of a data breach reached USD $4.45 million at the end of 2022, reflecting a significant 15% increase over the past three years. In response to these alarming statistics, 51% of organizations are now inclined to enhance their security investments after experiencing a breach. Their focus lies on strengthening incident response planning, providing comprehensive employee training, and reinforcing their threat detection and response capabilities to mitigate future risks.

In the case of an insurance brokerage firm that managed nearly $16 billion in risk premiums and maintained a vast network of offices across the United States, safeguarding sensitive information became an absolute priority. Their solution? OPSWAT MetaDefender Core. Below we will delve into the real-world challenges faced by this firm, explore why they opted for MetaDefender Core, and unveil the remarkable results they achieved.

Why Are Insurance Brokerages Being Targeted?

Insurance brokerages are prime targets for cyberthreats related to file upload security due to the wealth of sensitive and valuable information they handle. These businesses routinely manage vast amounts of personal and financial data, including policy holders' personal details, medical records, and financial records, making them a treasure trove for cybercriminals seeking to commit identity theft, fraud, or other malicious activities.

The convenience of digital file transfers in the insurance industry makes it easier for threat actors to exploit vulnerabilities in file upload systems, potentially leading to data breaches and financial losses. In this specific instance, the insurance brokerage firm operates on a national scale, with thousands of professionals across hundreds of offices throughout the United States.

While managing such an extensive network, they encountered several significant challenges:

- Pervasive Malware: The number of files received from customers, claimants, agents, and other sources constantly exposed their computer systems to the risk of malware infection.

- Regulatory Compliance: To remain in accordance with government mandates like the Gramm-Leach-Bliley Act (GLB), Sarbanes-Oxley Act (SOX), Federal Insurance Security Management Act (FISMA), and more, the firm needed an effective anti-malware solution.

- Time and Cost Concerns: Addressing malware-related issues consumed valuable time and resources, prompting the firm to search for a solution that could streamline this process.

Next-Level File Upload Security

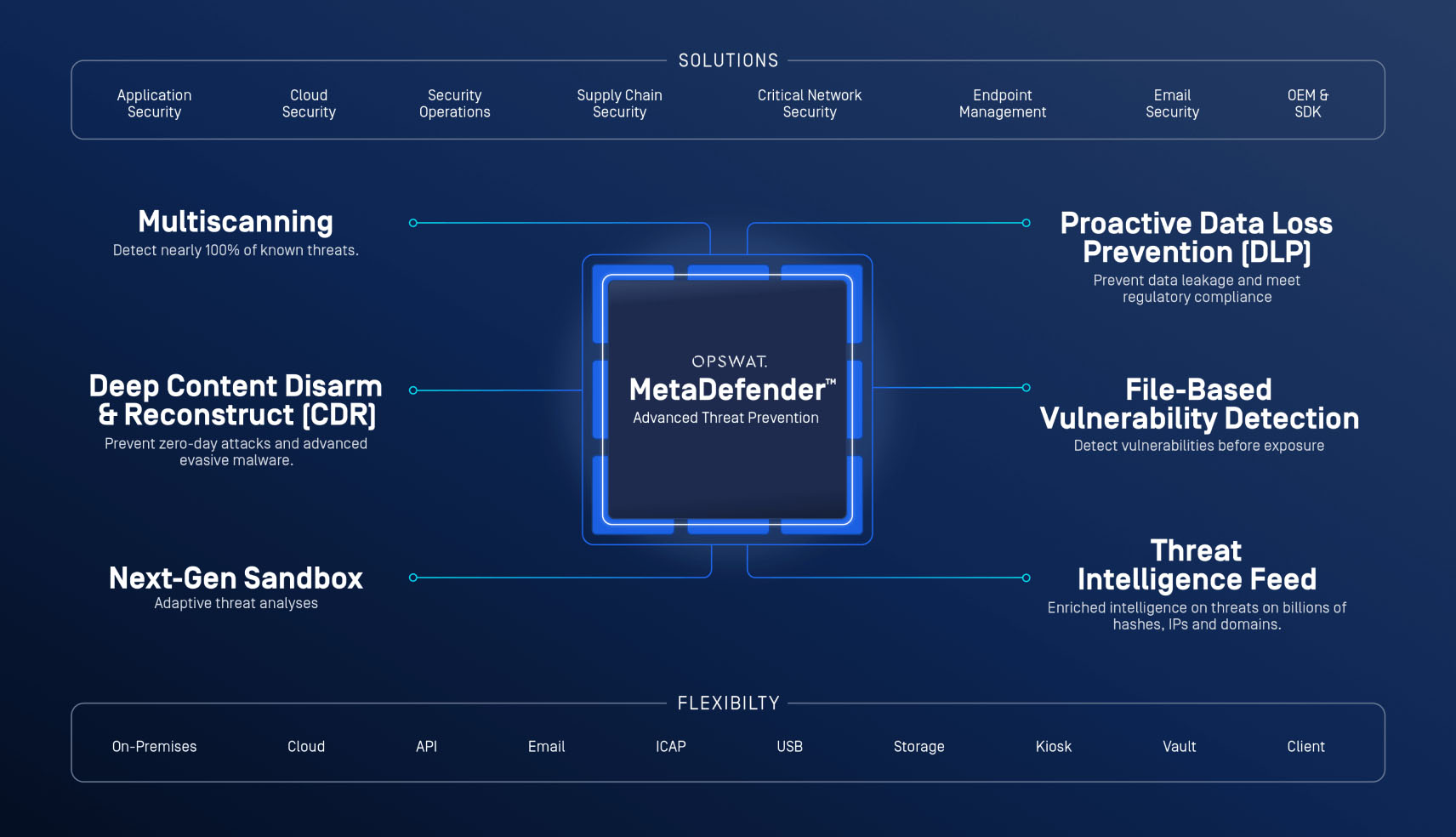

MetaDefender Core was selected by the brokerage firm as the most effective way to detect and prevent viruses, worms, Trojans and other malware from entering their information network. Integrated with Multiscanning technology and eight built-in antivirus engines, MetaDefender is used to thoroughly scan files for malware before those files are accepted by the firm.

MetaDefender Core also incorporates features such as custom post actions, which enabled the brokerage firm to exercise control over the data flow into their network. Using these custom post actions, the brokerage firm has established the following data flow: infected files are immediately quarantined, and the sender is informed of the malware detection. The sender is then requested to resubmit a clean file, and the infected file is deleted.

The Results

Malware Prevention

The firm has not reported a single malware-related problem from files since using MetaDefender.

Regulatory Compliance

OPSWAT helped the firm maintain compliance, meeting stringent government regulations, ensuring the security of sensitive financial data.

Cost Reduction

The firm no longer needs to allocate significant IT resources to remediate malware-related incidents.

Insurance, Ensured

The insurance brokerage firm's successful partnership with OPSWAT and MetaDefender Core is an example of how proactive measures can help protect organizations.

By prioritizing security, compliance, and efficiency, this undisclosed firm has fortified its position as a leader in the insurance industry, proving that safeguarding data and operations is a strategic imperative in today's digital world.